Across the industrial sector, low-carbon investing naturally leans toward renewable energy opportunities, like wind and solar power. But it can go beyond just renewables, and more industrial companies are taking the extra step to lower emissions with efficient energy technologies and by more accurately measuring their carbon footprint.

Investing in companies committed to low carbon emissions is both environmentally helpful and potentially rewarding. Most steps by companies to shrink a carbon footprint involve reducing current or future emissions by focusing on managing and reduction. But the clock is ticking toward a global net-zero carbon goal by 2050. And a small but growing number of companies are widening the scope of their decarbonization focus to include emissions savings and prevention, especially in their building facilities, which alone are responsible for 40% of all global CO2 emissions.

Incentives Grow for Companies to Save and Prevent Carbon Emissions

Although few companies gauge carbon-emissions savings now, we think the number will quickly grow. Sales growth will increasingly become tightly hinged on whether a company can accelerate the delivery or adoption of savings targets, especially with global governments and the private sector more united than ever behind the cause.

Some 200 countries now support the Paris Agreement and its aggressive goals to address global warming. New policies to deliver on the Paris Agreement and fight climate change are constant catalysts for higher public spending to help countries and businesses comply and to create demand for smarter public works, office parks and factories, to name a few. The European Green Deal, for example, will boost annual investment in energy systems and related infrastructure by an estimated €175–€300 billion (US$208–$357), and some US$2.2 trillion in low-carbon initiative spending is expected across emerging-market countries in the next two decades.

We believe this highly incentivizes more private-sector solutions for energy management, which will continue to unfurl in areas historically not known for it, such as transportation, industrials and building structures. And with just 1% of buildings even close to the Paris Agreement’s net-zero emissions target, demand for upgrades and renovations will grow exponentially in the next decade.

Scope 4 Emissions Help Gauge a True Carbon Footprint

From the service sector to heavy industrials, most businesses produce carbon, either directly or somewhere along their value chain. Carbon-output levels and types vary; however, we believe in factoring in the impact of CO2 emissions on the bottom line, also known as price on carbon.

As a core fundamental, price on carbon is most accurate when all types, or scopes, of CO2 get equal scrutiny. Generally, Scopes 1 and 2 emissions, respectively, are produced directly from a facility and indirectly from its energy consumption. In addition, certain Scope 3 emissions are important to consider in stock valuations, such as when evaluating a coal miner, and the emissions released when its customers burn the coal they produced.

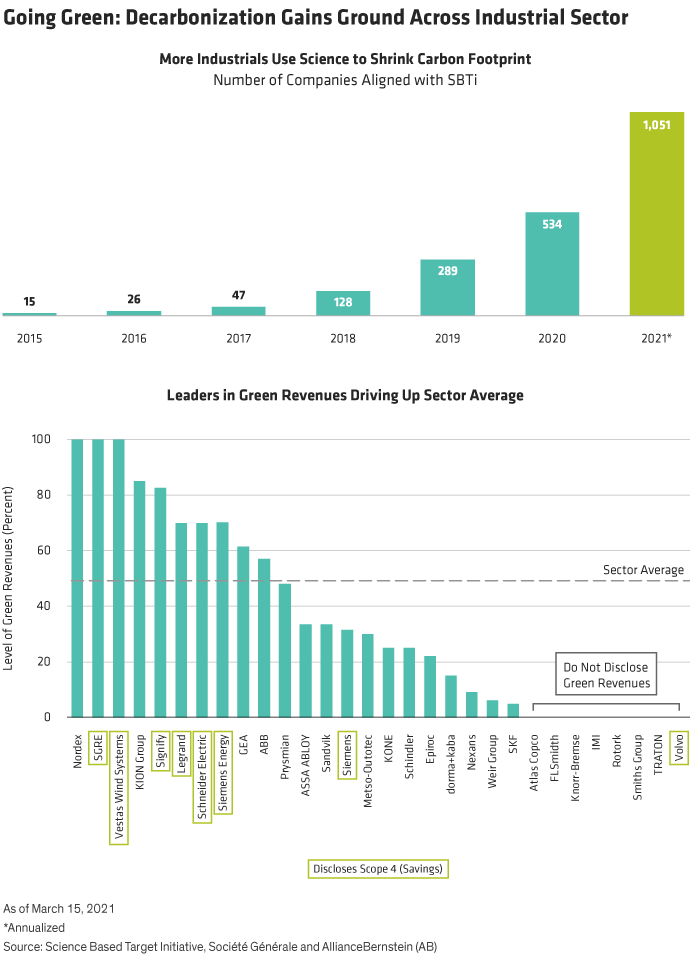

For all the right reasons, more companies are measuring and improving these telling metrics. This includes industrials, where the number of firms that rely on science-based emissions targets topped 500 in 2020 and likely will more than double in 2021, compared with about 15 just five years earlier (Display top). The sector’s green revenues—which measure a company’s exposure to products and services that are environmentally friendly—now average about 50% (Display bottom).

One increasingly relevant metric is still not widely adopted, but should be—Scope 4 emissions, which entail energy savings generated for third parties. Scope 4 reporting methodology remains more nuanced, but it generally pinpoints a company’s emissions output savings or all-out avoidance. And while Scope 4 emissions are not generally incorporated into valuation processes, they can be a key contributor to a company’s decarbonization and profitability goals, thus very attractive to active low-carbon investors.

Schneider Electric is one example of Scope 4 in action—contributing to lower carbon emissions by helping others reduce theirs. Schneider develops smart power grids and digitized buildings, which use technology and data centers to optimize electricity and water usage, to help customers save or avoid carbon production, conserve water and minimize waste. They conservatively estimate saving 89 million metric tons of CO2 for customers in 2019 alone. Similarly, Legrand and Signify, which make energy-efficient networked lighting systems, also are successful early adopters of helping clients manage Scope 4 emissions.

As more businesses get help with saving or avoiding emission output, higher transparency is sure to follow, much to the benefit of active low-carbon investors. Just a handful of companies disclose Scope 4 today. Volvo—with its strong foothold in the electric-vehicle market—and industrial conglomerate Siemens are among the Scope 4 pioneers.

Few companies, let alone industrials, know their true carbon footprint. But in an increasingly environmentally aware investment world, they should all prioritize and master it, in our opinion. As they do, investors must pay closer attention to how Scope 4 emissions affect a company’s overall output targets to draw a more accurate picture of its long-term competitiveness and return potential.

- Kent Hargis

- Chief Investment Officer—Strategic Core Equities

- Sammy Suzuki

- Co-Chief Investment Officer—Strategic Core Equities

Kent Hargis is Co-Chief Investment Officer—Strategic Core Equities at AllianceBernstein (AB)

Sammy Suzuki is Co-Chief Investment Officer—Strategic Core Equities at AB

Roy Maslen is Chief Investment Officer—Australian Equities at AB