If you’re a business owner or a partner in a private practice, you’re probably familiar with using a traditional 401(k) plan to fund your retirement. You may have even gone a step further, implementing a profit-sharing plan. For those already contributing the maximum who want to save even more, a cash balance plan may be a great opportunity for additional tax-deferred savings.

A cash balance plan is an employer-sponsored defined benefit program that enables you to defer substantially more pre-tax than other strategies allow. Contribution limits are based on age and, for older individuals, can be four or more times higher than for traditional retirement plans. Each partner/participant can choose his or her own level of contribution, but should commit to a contribution level for at least three years.

Recent tax rate proposals under the Biden administration are accelerating interest in these plans. This is especially true for individuals having taxable income of $1 million or more, who could potentially see a near doubling of their long-term capital gains tax rate from 23.8% to 43.4% and an increase in their ordinary income tax rate from 37% to 39.6%. Under these conditions, finding additional sources of tax deferral becomes even more critical.

How Much More Can You Contribute?

First, consider how much you can expect to put away for retirement under a 401(k) plan combined with profit sharing. As a 50-year-old, the maximum you can contribute is $26,000 per year to your 401(k) and another $38,500 a year to the profit-sharing plan, on a pre-tax basis.

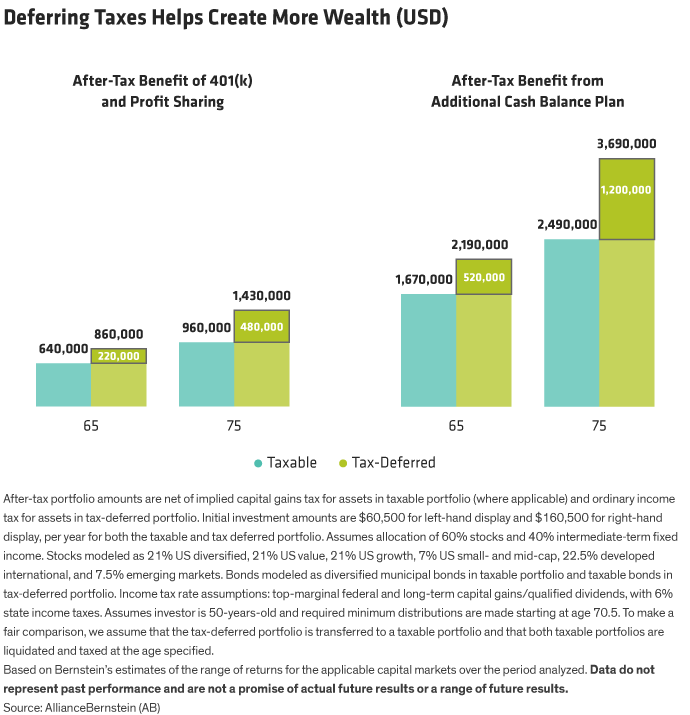

If you keep making these annual contributions until you are 65, on an after-tax basis your 401(k) and profit-sharing plan accounts would be worth $216,100 more than if you had invested the same money in a taxable account. If you were to wait until age 75 before distribution, the benefits of tax deferral would be even greater—up to $477,300.

But could you do better? If you add a cash balance plan, you could contribute as much as $162,000 more per year, bringing your potential total annual tax-deferred contributions to $226,500.

Let’s consider how an additional $100,000 annual pre-tax contribution to a cash balance plan could help the same 50-year-old business owner or partner. As expected, on a pre-tax basis, the tax-deferred accounts would grow significantly higher than their taxable equivalents. If you chose to cash out at age 65, your after-tax benefit would rise to $520,400 and potentially to as high as $1,200,900 if you held off distribution until age 75. Clearly, the addition of a cash balance plan can make a material change in your tax deferral capacity and future wealth.

Hedge Against a Million

What if your annual income is above $1 million? Given recent proposals to increase capital gains taxes at this threshold, cash balance plans may have extra benefits for high earners. Consider our same investor but assume that they have $1 million of employment income and $100,000 in capital gains. Under the Biden administration’s proposal, the capital gains would be taxed at the higher 43.4% rate. By reducing their taxable income below $1 million through their $100,000 plan contribution, they end up saving $19,600 ($43,400 – $23,800) in taxes on the $100,000 in gains. In these scenarios, the pre-tax deductions effectively convert a 43.4% capital gains rate to a 23.8% rate.

Is a Cash Balance Plan Right for You?

Cash balance plans aren’t economical for all businesses because you can’t offer the benefit to executives or partners without extending additional compensation to other employees. The demographics of your company’s workforce is the critical variable: In our experience, firms with a ratio of six employees to one owner are optimal. However, even if the ratio is as high as 10 to 1, a cash balance plan might be beneficial.

You also need to evaluate your personal capacity to save more. Given your current spending, can you afford to make these additional retirement plan contributions? Keep in mind that the tax savings from the additional contributions will help, and each partner in a firm can contribute a different amount.

Finally, it is important to understand the specific investment characteristics of this type of retirement plan. They typically have a timeline of seven to ten years, and accounts transition into IRAs or 401(k)s on termination. Once established, assets in a cash balance plan are typically pooled and invested with the goal of matching a target rate of return, typically between 3% and 5%.

It’s Not Too Late for 2021

As we enter the second half of the year the tax landscape remains uncertain, but the value of tax-deferral is clear. It’s not too late to consider implementing a cash balance plan for 2021. The first step is to reach out to your CPA or financial advisor, who can engage with an actuarial firm.

- Pavan W. Auman, CFA

- Director, Tax & Transition Strategies—Wealth Strategies Group