For the past year and a half, many institutions have had to dramatically change course, fill substantial revenue gaps—and in some cases—wholly reinvent their organizations to stay afloat. For some, new priorities and funding opportunities have resulted in novel revenue streams and/or excess cash. In either case, as the economy reopens and investment portfolios rebound, frontline leaders are surveying the landscape and contemplating optimal next steps.

What does the “new normal” look like for specific sectors and investors more broadly? And how should fiduciaries prepare for the future? In the wake of significant change and perhaps with a new financial baseline, now is the ideal time for nonprofit professionals to reflect on their overall investment program—from IPS to execution—and set a plan that is more relevant for the future.

Through our work at Bernstein with institutions of varying size, scope, and mission, we’re finding that the considerations below are helping decision-makers effectively reset.

Start on the Same Page

To determine next steps, you need a shared understanding of the starting place. Have there been any changes on the investment committee, the executive team, and/or the individual charged with staffing this committee? Do any adjustments need to be made to account signatories or reporting contacts?

For new members, schedule an orientation session that covers roles and responsibilities, including expectations for meeting frequency, preparation, attendance, and participation requirements. Importantly, members should understand their fiduciary duty to act prudently and in the best interest of the organization. In our white paper Balancing Structure with Flexibility, we highlight the path to building a solid fiduciary foundation. Educating committee members is an essential component.

Review Key Policies

When did you last ratify the IPS and Spending Policy? Distribute to the group and consider:

- What projections or expectations were set in the IPS regarding risk and return?

- Is today’s asset allocation in line with IPS guidelines?

- Have any major changes occurred at the institution, warranting a new time horizon and/or investment strategy for all, or just part, of the portfolio? (For example, a need to right size short-term reserves, or the addition of an asset pool with different allocation and liquidity needs?)

- Would a pivot toward responsible investing better align with our mission and vision, and how should we execute on this? Might it potentially enhance our portfolio’s return potential?

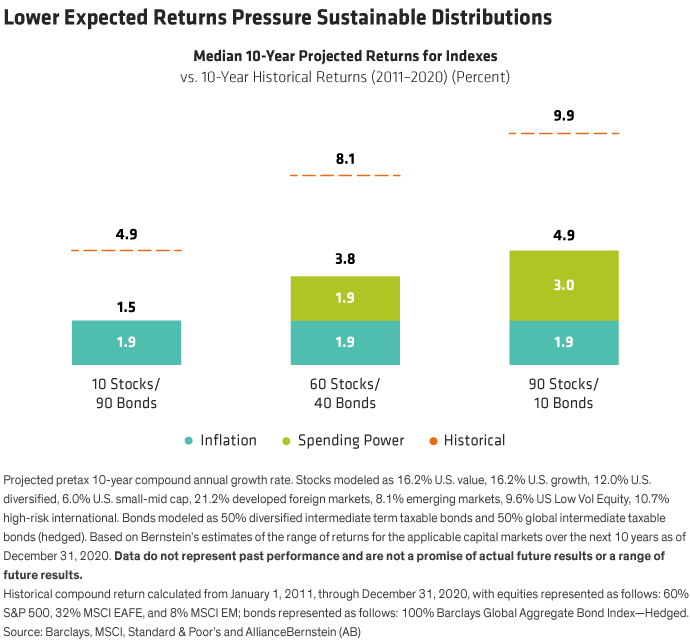

Bernstein’s current median projections for the next 10 years reflect lower returns and higher volatility across stocks and bonds than investors enjoyed throughout the last decade. If the current IPS includes expectations for a 60% global stock/40% taxable bond portfolio to deliver annualized returns of 8%, for example, that would have been spot-on in 2010. Today, to experience similar outcomes, you would likely need to make the following moves:

- adjust return expectations

- increase exposure to equities and/or inflation sensitive assets

- add some alternative income-producing assets

- lower the spending rate

- increase inflows into the portfolio

- or, in all likelihood, some combination of all of these.

As the display below shows, higher inflation expectations may further challenge your organization’s spending goals. Consider your ability to meet your projected annual spend not just in the context of lower expected returns, but also with an assumption of 1.9% annual inflation as a baseline. Keeping up will be harder than it has been in recent years.

Talk to your investment advisor for a review of your current strategy and investments in light of changing expectations.

Document and Implement

All action items should come with a plan to execute in a timely fashion, including a designated individual documenting minutes for each meeting. At the following meeting, this individual will confirm that all items from the last session were completed, and/or question why open items are still open. Without this rigorous follow-up, items may fall through the cracks.

Portfolio performance should be documented and analyzed in the context of the organization’s stated goals, in addition to comparing returns to relevant benchmarks. If external financial partners are utilized, evaluate the service level agreement, including communication, reporting, cost, and any other aspects of the relationship, now and on an annual basis. Clearly spell out expectations, provide specific feedback, and encourage outside advisors to share insight on improving the process.

Book It

Advance notice and adherence to agreed-upon time frames are critical for getting the most from busy committee members. Book the next fiscal year’s quarterly meetings now. Four weeks post quarter-end provides investment advisors ample time to distribute fulsome results with enough time for committee members to review and prepare in advance of the meeting. The agenda should be thorough but limited enough in scope to encourage active and inclusive dialogue, and to ensure each agenda item is given the necessary time and consideration for a thoughtful discussion.

Further communication is key across board committees, between board and staff, and to broader stakeholders. The strongest institutions provide financial transparency, and it’s a given that the most productive committees communicate clearly with auditors and other external stakeholders.

Reap the Rewards

The investment committee’s responsibilities in both protecting and advancing the goals of any institution may at times seem daunting, but they should also feel rewarding. After a particularly challenging time, the investment landscape is now shifting as well. By incorporating key practices for an effective team and by getting ahead of changing expectations for the capital markets, an investment committee that runs like a well-oiled machine should instill the confidence necessary for other key stakeholders to focus on what’s important—fulfilling the ultimate mission.

- Clare Golla

- National Managing Director—Philanthropic Services