S&P Dow Jones Indices recently removed automaker Tesla from its widely followed ESG Index, citing business conduct issues, including claims of racial discrimination and poor working conditions as well as deaths and injuries related to Tesla’s autopilot vehicles.

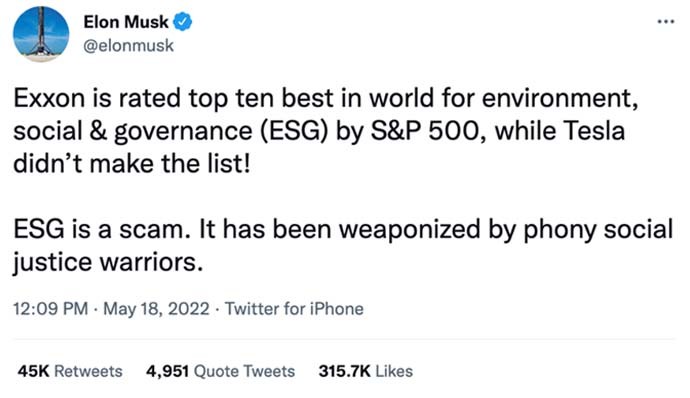

Tesla’s CEO Elon Musk did not take the news lightly. His millions of Twitter followers have since received a barrage of disparaging tweets about investment strategies that incorporate environmental, social, and governance (“ESG”) considerations.

Musk’s harsh attacks follow the publication of a few well-placed articles that prompted questions about whether ESG belongs in fiduciary portfolios. While valid questions are being asked about ESG broadly, that doesn’t mean that investing with an ESG focus is without merit. It may just require an additional level of due diligence. Essentially, investors need active research and engagement to truly assess ESG risks, opportunities, and direction—not just a single “grade”.

Musk Raises Important Concerns, but His Reaction Is Misguided

Musk raises a worthwhile objection. Formulaic ESG ratings can sometimes miss the forest while focusing on the wrong trees. By accelerating the acceptance of electric vehicles, Tesla deserves credit for long-term environmental impacts that are not captured by just focusing on carbon footprint. And Musk is right that the overall environmental benefits of owning a Tesla versus a similar internal-combustion-engine vehicle are substantial.

Clearly, third-party ESG ratings are by no means perfect (Display). Here are some of their drawbacks:

- They represent a static look in the rearview mirror: they don’t reflect a company’s potential for improvement or its vulnerability to possible future risks.

- They rely partly on nonfinancial information that is self-reported, so scores are based on what a company says, rather than what it’s done.

- They also draw heavily on automated tools that extract data from websites (“web scraping”). This information may not be wholly reliable or may even have been planted by companies together with key words that are readily recognized by search bots.

- Large companies that can afford to collect and translate all the necessary data to achieve a rating tend to get awarded higher scores.

- Crucially, corporate ESG ratings do not necessarily measure a company’s impact on the Earth and society. Rather, some simply assess the way a company manages current ESG risks and opportunities in terms of impact on its bottom line. This rating approach focuses on whether a company is protecting its financials, as opposed to taking substantive steps to creating a greener and better world.

Take It Up with S&P

Rating services’ coverage varies across asset classes, criteria, rigor, and output. There are no current industry or regulator standards for algorithms, metrics, data sources, or results. The result? ESG ratings can vary wildly across providers. In the case of Tesla, for example, MSCI and Sustainalytics haven’t downgraded the company like S&P has.

We believe that uniform ESG ratings should not be anyone’s goal. It’s healthy to have different viewpoints about the ESG performance of companies to create a more well-rounded view of ESG risks and opportunities, in the same way that we wouldn’t want all sell-side analysts to have the exact same financial outlook for a company.

Yet, despite the subjectivity and evolving nature of ESG ratings, Musk is wrong to call ESG a scam. He disagrees with one ESG rating provider’s view of his company: his argument should be with the methodology used by S&P, not with those in the investment community who are trying to improve broader ESG transparency and accountability.

There Are Three Letters in ESG

It’s worth remembering that ESG includes each of E, S, & G: environmental, social, and governance. Tesla clearly advances environmental goals but depending on how an organization rates or weights governance, it might completely offset or outweigh the “E” impacts.

We agree that Tesla could stand to improve its governance. Issues like the questionable management of waste from the manufacturing process, claims of racism at manufacturing facilities in California, and controversies caused by the way Musk uses his public platform may present long-term risks for the company.

As we wrote in a recent post on sustainable bond investing, the auto industry illustrates the difficulty of finding a perfectly sustainable private sector investment. General Motors and Ford Motor, for example, have made significant commitments to building out their electric vehicle lines in recent years. Yet these companies still rely heavily on sales of relatively fuel-inefficient trucks and SUVs. Does that mean Tesla is automatically a better investment from an ESG perspective? Not necessarily, given the risks presented by the company’s well-publicized problems.

Thorough Research and Engagement Are Key for Successful ESG Investing

Third-party ESG ratings are no substitute for independent fieldwork to develop a complete picture of corporate behavior. It’s necessary to engage with management and seek to understand the ecosystem in which a firm operates. That’s why we consider it crucial to produce our own ESG insights and engagements using our research plus external sources.

What’s more, ESG is not just “doing good”. Companies that are focused on improving and addressing ESG concerns are aiming to future-proof themselves. ESG is a financial imperative—whether that means preparing for regulatory change, a competitive landscape where purchase decisions reflect ESG credentials, or attracting employees who are increasingly making value-based decisions on where they want to work.

Ultimately, investors who rely purely on third-party ESG data and ratings forego the opportunity to drive change and may overlook one of the key levers to improve corporate performance—engagement for action.

- Travis Allen

- Managing Director