2019’s equity markets turned out to be better than many investors predicted. Global stocks were up more than 25% while the US ended the year 30% higher. Moves by the US Federal Reserve and better than feared geopolitical news spearheaded the robust gains. Despite this strong performance, not everything’s rosy. The economy is still somewhat fragile, particularly the relationship between business confidence and labor market strength. This issue, among others, will be a critical driver of US growth this year.

A Pivoting Fed Led 2019’s Rally

Entering 2019, investors expected the Fed to hike interest rates. Instead, they did an about-face in light of weak economic data, and lowered rates by 75 basis points during the year. Alongside this loose monetary policy, improved sentiment on geopolitical issues—namely the China trade dispute—eased concerns that a recession was on the horizon. Instead of contracting, the economy grew, albeit at the slowest pace since 2016.

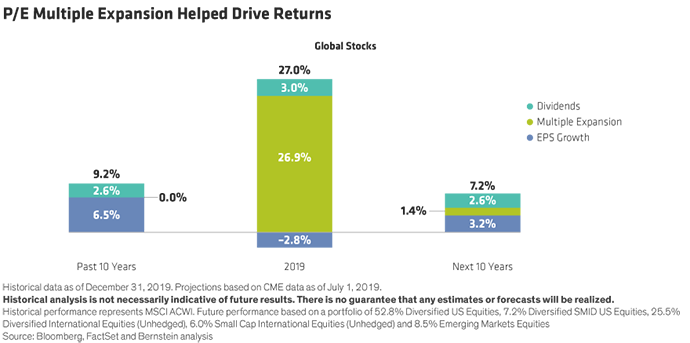

Global equities responded to the more favorable environment. Despite negative earnings growth, stocks rose almost entirely because of multiple expansion (Display). In contrast, over the last ten years, earnings drove returns and we forecast that earnings and not valuations will power returns over the next decade.

The confluence of accommodative Fed policy and a better outlook on geopolitical tensions, propelled the 2019’s strong market performance. But some of the factors that underpinned investor’s initial worries have not resolved.

Will business confidence, trade, and manufacturing sober the markets…

CEO confidence has been deteriorating since early 2018, coinciding with the tip-off of the trade war. At the same time, global trade volumes began declining, and last year, turned negative.

As a result of the diminished trade volumes, global manufacturing dipped and remained in contraction territory for the first time since 2012. We believe these two factors—trade and manufacturing—are the key contributors to low CEO confidence.

…or will continued labor strength prolong the party?

Despite these weaknesses, hiring has continued apace, resulting in unemployment at 50-year lows. But the disconnect between confidence and labor needs to be monitored, mainly because we believe a weakening labor market would spill over into consumption—which makes up the bulk of US GDP growth.

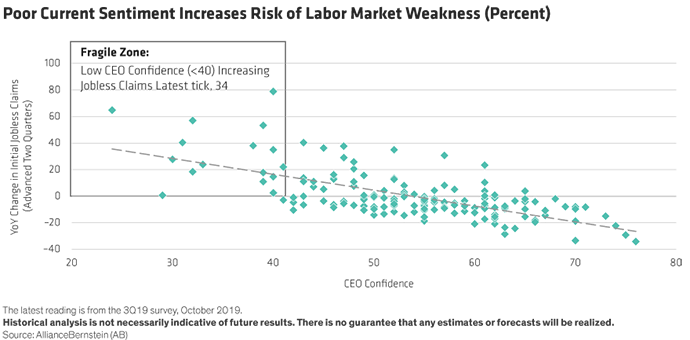

Low CEO confidence generally signals increased layoffs (Display). The most recent confidence reading was 34*, which in the past indicated a roughly 20% rise in jobless claims over the next six months. If past precedent holds, unemployment may rise, and in turn, reduce consumer spending and hurt growth.

2020—slower and still uncertain

Economic growth should slow modestly further this year. As mentioned, though, this growth could be hindered by labor weakness which, in our opinion, would cause the Fed to lower rates again in 2020. Further, geopolitics—including a US election—will loom large this year, which will likely cause increased volatility and market uncertainty..

This uncertain, but somewhat more stable backdrop, argues for portfolio diversification. Diversifying by geography, asset class, and market factors can create multiple unrelated return streams that should mitigate a surge in volatility and reduce downside risk if it were to occur.

*Reading for 3Q19

For more on trends in the economy, markets, and asset allocation for long-term investors, explore The Pulse, a Bernstein podcast series, and for additional thought leadership, check out the related blogs here.

- Matthew D. Palazzolo

- Senior National Director, Investment Insights—Investment Strategy Group