Global stock markets rallied in 2019, defying political and macroeconomic uncertainty. Will investors be as fortunate in 2020? Since many risks remain, maintaining style diversity and finding investing themes that are detached from volatility drivers will be important ingredients for equity allocations.

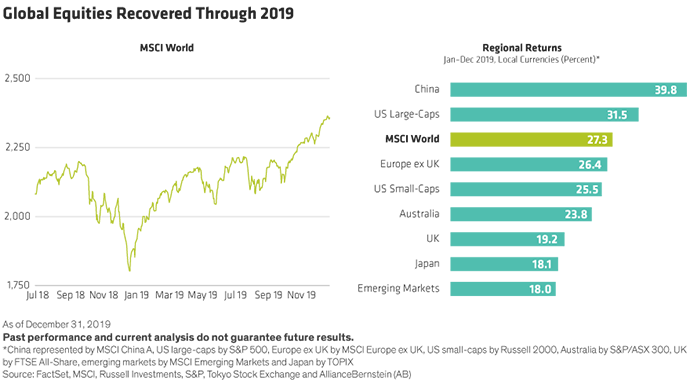

Investors will look back on 2019 as a curious year for stocks. After a sharp correction at the end of 2018, the MSCI World Index went on to rally by 27% in local-currency terms. But looking at 2019 in isolation is misleading. In fact, stocks have been clawing their way back from the 2018 downturn. The MSCI World only exceeded its September 2018 peak in the second half of 2019 (Display, left).

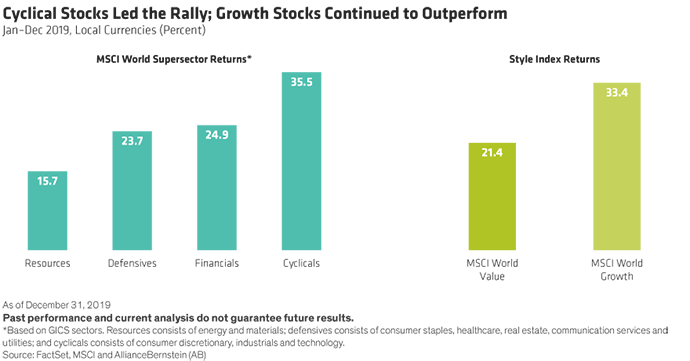

In developed markets, US large-cap stocks led the global gains (Display above, right). While emerging markets were relatively weak, Chinese stocks—perhaps surprisingly—surged through the constant rumbling of trade war tensions. Cyclical stocks fueled the global rally (Display below, left). And growth stocks led the markets once again throughout most of 2019 (Display below, right), though there were brief signs of a value recovery in the third quarter.

Last Gasps for Bull Market?

Are these the last gasps of a decade-long bull market? This question is on everyone’s mind as the new year begins—and there’s no clear answer. What’s clear is that despite the prolonged climb of stocks, investors are asking whether the conditions that got us here will persist.

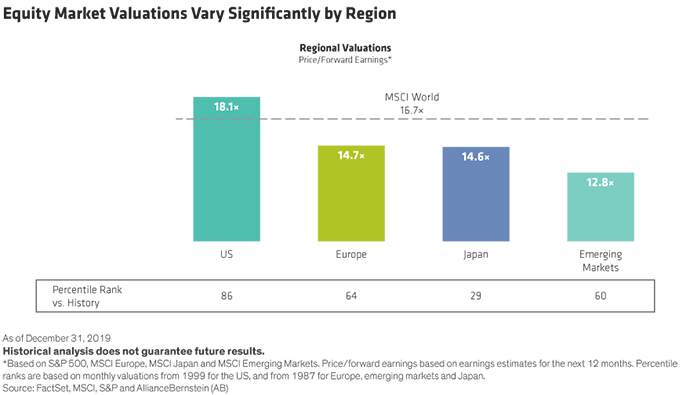

So, what powered stocks in 2019? We think the strong sentiment was driven by the fading of worst-case scenarios. Global macroeconomic growth hasn’t collapsed—it has continued to expand at a modest pace worldwide. Loose monetary policies of major central banks and historically low interest rates have continued to provide structural support for stocks. By year-end, global equity market valuations were somewhat high from a historical perspective, though regional markets varied. European and Japanese stocks looked more attractive than their US peers (Display).

No Escape from Volatility

Equity gains were anything but smooth. Over the last two years, stock markets have been much more volatile than in the previous years. Global stocks were up or down more than 1% on 71 days in 2018 and 2019, compared with only five such days in 2017.

Market unrest has been fueled by real concerns. Will the US-China trade war be resolved or deteriorate? Does Brexit threaten European economic and political stability? How will the US presidential election play out? Can the global economy arrest a slowdown? As 2020 began, markets were rattled by new geopolitical tensions after the US killed a senior Iranian general in a drone strike and Iran threatened revenge. Oil prices rose and stocks were shaky amid fears of a broader military confrontation between the US and Iran, as well as potential effects across the Middle East.

These new concerns overshadowed some reassurance that investors received in December about potential relief on two fronts. The first phase of a US-China trade truce offered hope of further de-escalation between the two economic powers. And the resounding victory of Boris Johnson’s Conservative Party in British elections suggested that the UK will have a clearer path to completing Brexit. Still, in both cases, a long and winding road must be traversed before the risks are completely defused and investor worries are fully alleviated.

Even before the trade truce and the UK election, investors were feeling more confident about 2020. A Bank of America survey of 247 fund managers conducted between December 6 and 12 found that, after two years of weakening sentiment, optimism over global economic growth had started to recover. Consensus analyst estimates expect global earnings to increase by a solid 10% in 2020.

Is the Optimism Premature?

It’s tempting to believe that things are getting better. We prefer a balanced view of the risks and opportunities. There are real dangers that cannot be ignored. At the same time, stronger growth, more loose monetary policy and fiscal easing could set the stage for another solid year for stocks. Since it’s nearly impossible to predict inflection points in erratic markets, we think investors should stay in stocks but do so with a degree of style diversification to help offset temperamental market swings.

Last year’s style patterns reinforce the case for scrutinizing style and regional exposures. For most of 2019, growth stocks outperformed value stocks by a wide margin. But value stocks outperformed sharply in September, reminding investors of how quickly style sentiment can turn and refocusing attention on an asset class that has been out of favor for most of the last decade.

Balancing Style and Regional Exposures

The valuation gap between equity styles remains extreme. By year-end, global growth stocks traded at a P/FE ratio of 22.8, versus 13.1 for value, based on the MSCI World Growth and Value indices, respectively. Minimum-volatility stocks, which had become quite expensive during 2019, lagged toward the end of the year.

From a regional perspective, US equities have outperformed other developed markets for more than a decade since the global financial crisis. While US stocks are still an important component of a global equity allocation, we think investors who have been underweight non-US markets should reconsider their positioning.

US Healthcare: Durable Developments

In any equity allocation, current conditions make it especially important to proactively assess the vulnerability of holdings to risks that can’t be easily predicted. Of course, no stock or equity portfolio can be isolated from macro- and market-driven volatility. But holdings that have some degree of business resilience can help provide some stability from market turbulence.

In the US, for example, political risk is widely seen as a source of volatility for the healthcare sector. With a debate raging about private insurance reform and drug pricing, healthcare stocks are widely expected to be unsettled as the November 2020 presidential elections draw closer.

So should equity investors avoid the healthcare sector entirely? We don’t think so. Some healthcare companies that operate in virtuous ecosystems aren’t directly affected by the political debates. In areas such as gene sequencing and robotic surgery, demand for innovative products and services is unlikely be derailed by politics. Healthcare companies with products that offer clear benefits, improve the efficiency of the healthcare system and are profitable should be able to deliver results long after the political hubbub—and the associated sector volatility—fades. Even select health insurers are well positioned for any eventual realignment of the US healthcare sector.

Global Technology: Enduring Trends

Technology trends with staying power can also be found. Look for subindustries and companies in the sector that are impervious to the regulatory issues that shook investors’ enthusiasm toward mega-cap giants in 2019. For example, as devices continue to get smaller, companies with technological advantages to help enable the production of high-quality shrinking semiconductors should enjoy a solid demand, in our view.

IT services also offer attractive potential. As companies across industries undergo digital transformations, IT services and tech companies that provide new cloud-based services should benefit. The reason is simple. Digitalizing businesses is no longer an option—it’s essential for unlocking greater efficiencies and profitability, especially in a low-growth world.

High Conviction to Take the Heat

What do the disparate trends mentioned above have in common? First, they aren’t directly tied to a macroeconomic or political outcome. That doesn’t mean companies in these industries are immune to volatility, but it suggests that over the long term, their fundamentals should prevail. Second, finding companies in these areas and developing high conviction in them requires deep fundamental research.

At the same time, it’s essential to make sure an overall allocation is diversified; it would be imprudent to just stay overweight sectors and styles that have done well recently given the speed at which equity market sentiment can shift. Alternatively, core equity portfolios can be used to neutralize style biases, and low-volatility equity portfolios can be constructed to provide defensive positioning for potential downturns.

Investors who stayed on the sidelines in 2019 because of volatility in 2018 paid a heavy price for choosing not to participate in the market. By using fundamental research to find companies that can take the heat in stride and building strategic allocations that can capture return potential with volatility awareness, investors can gain the confidence to stay in the market through challenging times ahead in 2020.

- Sharon Fay

- Chief Responsibility Officer

- Christopher Hogbin

- Head—Equities