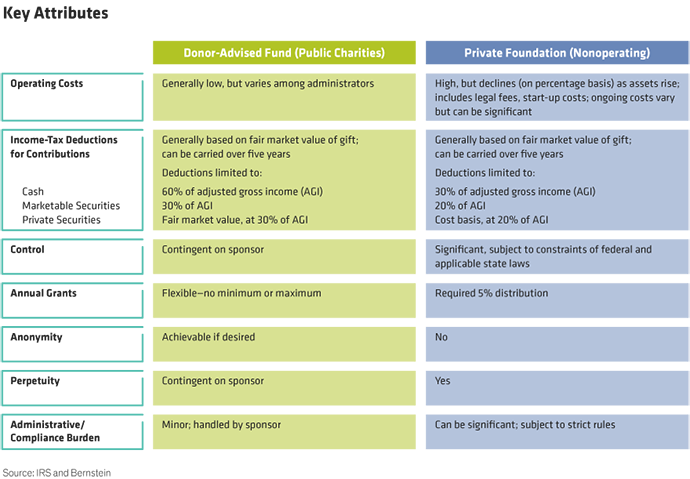

How do you choose between starting a private nonoperating foundation and a donor-advised fund? In many ways, these charitable vehicles are quite similar. Both can be perpetual in nature, allow you to establish a legacy, engage your family in your giving program, and pass on your philanthropic values to your next generation. But there are some key differences (Display). Low cost and highly flexible, donor-advised funds (DAFs) have become philanthropy’s fastest-growing vehicle in recent years. However, there’s one significant drawback—you cannot always control how your dollars are allocated from a DAF; with a private foundation, you can. That control, though, comes at a cost—both monetary and of time. Deciding which vehicle is best for you, though, doesn’t need to be an either/or choice. Sometimes combining them may make the most sense.

Better Together?

Linking a DAF with a private nonoperating foundation may be beneficial to achieve specific goals. Here we highlight three examples.

- Gifting Flexibility: Even when a private foundation is doing the lion’s share of philanthropic giving, there are times when having a donor-advised fund available makes sense. One instance is when a foundation is refining its strategic vision—whether its newly established or shifting focus—a “sister” DAF can be used to receive the required 5% distribution so that the donor can direct that distribution sometime in the future when the strategic vision is instituted.

Another example is when the stock market has a stronger year than anticipated and the required distribution may be higher than originally planned. When this happens, a donor may not have an additional grant lined up and may need more time to determine where to make a gift. For example, if a foundation has $10 million in assets and a minimum required distribution of $500,000, it could grant $400,000 to the qualified nonprofit organizations that have already been identified and $100,000 to a sister DAF. This will allow time to decide how to distribute the $100,000.

- Long-Term Passions vs. Ad Hoc Giving: Often, a family is passionate about specific causes. But they also have other demands for their charitable dollars throughout the year—appeals from friends and colleagues, donations to their children’s schools, and unexpected events like natural disaster relief. Establishing both a private foundation and a DAF can help separate gifting between longer-term causes and near-term donations. The private foundation will have a clear mission and vision around long-term passions, and a DAF will focus on more ad hoc giving. When using both vehicles, best practice is to establish clear granting policies for each that reinforce their focus.

- Maximizing Tax Benefits: A donor is considering funding both a private foundation because of the control and ability to compensate

family members down the road, and a DAF for its anonymity and easy structure. The funding will come from highly appreciated publicly traded stock and shares of a private company. Since the tax benefit differs depending on the assets used to fund the vehicles, choosing the right asset for each is paramount.

Charitable deductions vary depending on the type of asset given and the vehicle. For public securities, the deduction is higher for a DAF than a foundation—30% vs. 20% of adjusted gross income (AGI), respectively. For private stock, deductions are based on the cost basis and limited to 20% of AGI. Deductions for contributions of private stock to DAFs are based on fair market value, limited to 30% of AGI. In this case, the basis in the private stock is zero, so the fair market value is significantly higher. So, to maximize the charitable deduction, the donor should fund the private foundation with the appreciated publicly traded stock and the DAF with the private shares.

Planning Depends on What’s Right for You

Your philanthropic plan should be tailored to your specific needs. There’s no “one-size fits all” when it comes to structuring your giving and determining which assets you should use to fund your charitable aspirations. At times, a private nonoperating foundation may be the logical choice; other times a DAF will fit the bill. But sometimes having both is the best solution. It’s important to look at what your mission and vision are and determine which path or pathways you should take to reach your goal.

To learn more about creating a customized philanthropic plan, read “Philanthropy: Rooted in Your Values.”

- Anne Bucciarelli

- Senior National Director—Family Engagement Strategy

- Jennifer Ostberg, CFP®, CAP®

- Director—Personal Philanthropy Services