As more plan participants worry about retirement income security, demand for guaranteed income solutions is growing—and plan sponsors are pondering the options. While there are many ways to measure the benefits, we believe that some approaches—like in-plan and default options—have distinct advantages.

In response to the far-reaching economic impact of COVID-19, many plan sponsors have intensified their focus on critical priorities like handling furloughs and making emergency distributions. As conditions slowly return to normal, we expect renewed emphasis on plan design to tackle a top-of-mind issue: retirement income security.

Lifetime-Income Demand Grows…but Adoption Lags

Strong demand from plan participants for reliable retirement income could be incentive enough for sponsors to start taking next steps now.

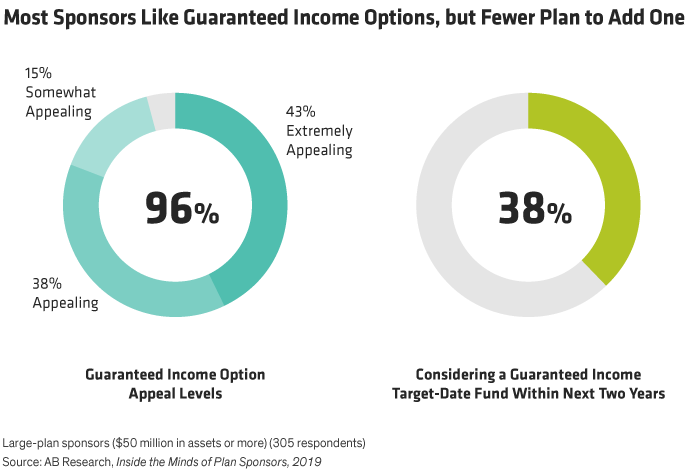

Some 87% of plan participants who use target-date funds considered some form of guaranteed income option—such as an annuity—appealing, according to AllianceBernstein’s (AB) Inside the Minds of Plan Participants survey. Plan sponsors agree: 96% expressed some appeal to adding a target-date fund guaranteed option, based on our latest survey. But a much smaller group (38%) actually plans to follow through any time soon (Display).

If the benefits of and demand for guaranteed income options are clear, what’s the reason for the disconnect between interest and action? For many plan sponsors, the path to offering these solutions isn’t as clear-cut as the need. And lingering uncertainty about how to evaluate and implement them are, in our view, still hurdles.

The good news? The gap between high appeal and low implementation of guaranteed income options seems to be narrowing.

The passage of the Setting Every Community Up for Retirement Enhancement (SECURE) Act in late 2019 helped clarify some of the bigger sticking points for plan sponsors. For example, the law introduced a safe harbor for choosing annuity providers inside a defined contribution (DC) plan, which we believe opens a protective path for even more fiduciaries to adopt lifetime income solutions.

The Advantages of In-Plan Approaches

Despite the regulatory boost to guaranteed income options, plan sponsors still need to decide exactly what form that solution should take. Two top-of-mind questions: Should they offer an in-plan or out-of-plan option? Should it be a Qualified Default Investment Alternative (QDIA) that participants are defaulted into or an opt-in strategy available at retirement?

Adding any type of guaranteed income options can strengthen a plan, but we feel strongly that an in-plan default option offers broader participant adoption and cost efficiencies, among other benefits. In-plan solutions, for example, provide scale, which can net better pricing versus retail annuity options. As a QDIA, guaranteed income solutions have the biggest reach and usage, too. Plans deploy auto-enrollment, auto-escalation and other inertia-based levers to boost participants’ savings—and potential retirement income.

There are softer but equally impactful benefits, such as giving participants peace of mind that they’ll be able to retire when they want and on their terms. With 56% of participants in our survey saying their top savings goal is to ensure a secure retirement income, an in-plan option with hands-on control can also be an effective tool for employers to recruit and retain talent.

As fiduciaries, plan sponsors that offer an income solution throughout the working years can also build participant appreciation and trust in it, as opposed to something made available at retirement from a source outside the plan. And because in-plan options accompany participants over a long time period, plan sponsors can provide ongoing education and guidance to support employees and help them customize their savings strategies.

Are DC Plans for Savings or Retirement Income?

With retirees living longer, more sponsors are revisiting the purpose of their DC plans and asking a central question: Are plans only for supplemental savings or to help participants draw a meaningful retirement income for life?

Clearly, the need for lifetime income is strong and growing, and plan sponsors looking to move in this direction have a lot to consider if they want to deliver customizable income solutions that work for every participant.

Design flexibility is important, such as the means to “buy into” income guarantees over time with some added protection from market downturns. Participant engagement is also key, especially if they’re going to understand what they own and how it helps. Perceptions of annuities can generally be mixed, but merely educating participants on how their features address longevity and market risks—as well as concerns for inflation, interest rate changes and other worries—may help put minds at ease.

As the industry ramps up to address the growing need for strategies to help participants begin drawing income from their accounts, it’s increasingly clear that both employees and sponsors overwhelmingly find guaranteed income options appealing. Participants have further demonstrated they want something simple, certain and controllable. As we see it, plan sponsors should give these solutions strong consideration.

- Jennifer DeLong

- Managing Director—Head—Defined Contribution

- Andrew Stumacher

- Managing Director—Defined Contribution

Jennifer DeLong is Managing Director, Head—Defined Contribution at AB.

Andrew Stumacher is Product Director—Custom Defined Contribution Solutions at AB.

“Target date” in a fund’s name refers to the approximate year when a plan participant expects to retire and begin withdrawing from his or her account. Target-date funds gradually adjust their asset allocation, lowering risk as a participant nears retirement. Investments in target-date funds are not guaranteed against loss of principal at any time, and account values can be more or less than the original amount invested—including at the time of the fund’s target date. Also, investing in target-date funds does not guarantee sufficient income in retirement.