Despite differences in ideology, practice, location, and size, many religious organizations face the same challenges. Shifts in generational demographics, declines in religious affiliation, and changes to tax legislation are driving declines in giving. At the same time, these financial challenges are exacerbated by another issue: the cost to maintain (often aging) real estate holdings. These costs are increasing at a pace, in some cases, more rapid than revenue declines.

Stewardship of Mission

Faith-based groups are at a crossroads—defining and perhaps redefining their future roles in the community while facing financial instability. At the core is a critical question: How can they increase current revenues to support burgeoning costs? Ironically, real estate holdings are often the cause for most of the growing costs, but in some cases, they can also be leveraged for stewardship in service of mission.

According to Dr. John Scibilia, Executive Director of the Council of Church Advisors, religious groups are functioning in “survival mode rather than in the what-do-we-want-to-do mode.” The money itself becomes the focus instead of how organizations can make a difference in society and accomplish their mission. Bernstein Principal and Financial Advisor Kim Davis agrees, stating that “regardless of their size and history, religious organizations are driven by human beings, and what they want to accomplish collectively is what should drive these organizations[...] It’s imperative that financial structure matches an organization’s commitment to the community.”

Davis defines this intersection of an organization’s mission and its financial sustainability as Total Mission Value (TMV). TMV, a derivation of our total philanthropic value metric, is “ the accumulation of all the dollars dedicated to mission and ministry over the years plus whatever the organization has remaining in the endowment or savings. It’s not just about what’s left on the balance sheet in 30 years, but it’s also about all the good that has been done in support of the mission and ministry.” Establishing shared objectives for TMV creates a dual focus on long-term financial sustainability and the funds spent in service of mission. We discuss the impact of TMV in the following case study.

Case Study: Sell or Lease? Spend or Save?

A church in a gentrifying urban area owned an adjacent vacant lot. The congregation needed an income stream to support the ministry’s daily operating expenses, so they considered whether they should sell or lease the lot. The church opted not to sell the property, but rather retain it to provide limited parking for its members while leasing the balance of the lot.

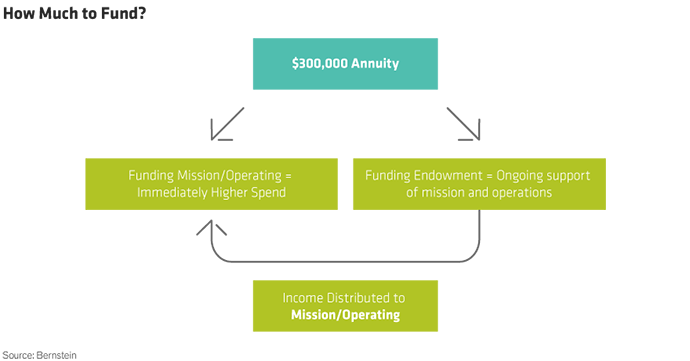

The church accepted a development proposal with a triple-net ground lease of the property for 99 years; this came with a rent of $300,000 for the first year and 5% escalations every five years. Next, they had to determine the best uses for the income—how much to designate to their endowment or long-horizon investments, and how much to their short-term operating fund (Display)?

The church considered two options using a portfolio that consisted of 60% stocks and 40% bonds*:

- 30% allotted to the church’s endowment, and 70% to the operating fund

- 70% to the endowment, and 30% to the operating fund (Display)

Weighing current and future operating needs, the church opted to allot 70% of each year’s proceeds to the endowment. This would create higher total wealth of $14.4 million, about 11% more than if they allotted only 30% to the endowment, with more funds to support and grow their ministry in the future as well as a near-term operating reserve to help maintain liquidity during more volatile markets. The church would see the fruits of their ministry today, and in the years to come.

Governing for Success

While TMV provides a framework for decision-making, governance structure guides fiduciaries and their professional advisors regarding authority, accountability, and parameters for those decisions. Critical to ensuring that funds are handled timely, with integrity, and with transparency, is to establish standard governance structure and procedures. This includes an investment policy statement (IPS) that outlines acceptable projected risk and return, investment strategies, authority, and accountability of various involved parties, and perhaps spending guidelines, to name a few. It also acts as a historical account or institutional memory for future fiduciaries and stewards of the organization’s mission.

Today and Tomorrow

Given today’s trends and challenges, faith-based organizations and other nonprofits need to become more strategic with every dollar. Part of that is understanding the growth potential of your assets—by utilizing forecasting tools based on capital markets assumptions and projecting future. Another part is optimizing “asset location” —how much to allocate and in what mix of investments to spend or save. Being asset smart will help you serve your mission today, and tomorrow.

*Asset allocation for 60/40 portfolio is 55% Global Stocks/40% Intermediate Taxable Fixed Income/5% Real Assets. Data do not represent past performance and are not a promise of actual future results or a range of future results.

For more on timely topics for nonprofits, explore “Inspired Investing,” a Bernstein podcast series that covers investing, spending, policy, and more for Endowments & Foundations, and for additional thought leadership, check out the related blogs here.

- Clare Golla

- National Managing Director—Philanthropic Services

.jpg)